The minutes of the board of directors of the Mary- gold Catalogue Company Ltd. for the year

Question:

The minutes of the board of directors of the Mary- gold Catalogue Company Ltd. for the year ended December 31, 2001, were provided to you.

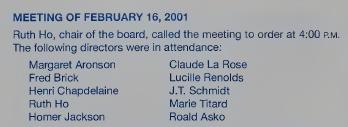

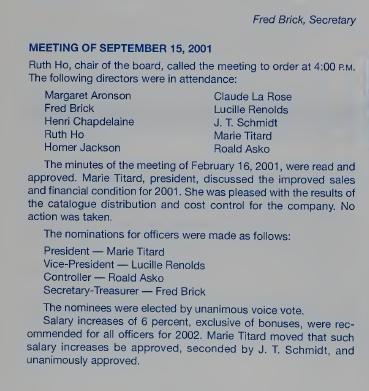

The minutes of the meeting of October 11,2000, were read and approved.

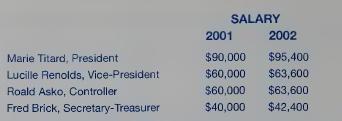

Marie Titard, president, discussed the new marketing plan for wider distribution of catalogues in the western market. She made a motion for approval of increased expenditures of approximately \($50,000\) for distribution costs which was seconded by Asko and unanimously passed.

The unresolved dispute with the Canada Customs and Revenue Agency over the tax treatment of leased office buildings was dis¬ cussed with Harold Moss, the tax partner from Marygold’s public accounting firm, Moss & Lawson. In Mr. Moss’s opinion, the matter would not be resolved for several months and could result in an unfavourable settlement.

J. T. Schmidt moved that the computer equipment that was no longer being used in the Kingston office, since new equipment had been acquired in 2000, be donated to the Kingston Vocational School for use in their repair and training program. Margaret Aron¬ son seconded the motion and it unanimously passed.

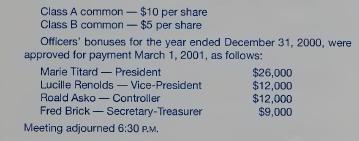

Annual cash dividends were unanimously approved as being payable April 30, 2001 for shareholders of record April 15, 2001, as follows:

Roald Asko moved that the company consider adopting a pen¬ sion/profit-sharing plan for all employees as a way to provide greater incentive for employees to stay with the company. Consid¬ erable discussion ensued. It was agreed without adoption that Asko should discuss the legal and tax implications with lawyer Cecil Makay and a public accounting firm reputed to be knowledgeable about pension and profit-sharing plans, Able and Bark.

Roald Asko discussed expenditure of \($58,000\) for acquisition of a new computer for the Kingston office to replace equipment that was purchased in 2000 and has proven ineffective. A settlement has been tentatively reached to return the equipment for a refund of \($21,000\). Asko moved that both transactions be approved, sec¬ onded by Jackson, and unanimously adopted. Fred Brick moved that a loan of \($36,000\), from the Kingston Bank, be approved. The interest is floating at 2 percent above prime. The collateral is to be the new computer equipment being installed in the Kingston office. A chequing account, with a minimum balance of \($2,000\) at all times until the loan is repaid, must be opened and maintained if the loan is granted. Seconded by La Rose and unanimously approved.

Lucille Renolds, chair of the audit committee, moved that the public accounting firm of Moss & Lawson be selected again for the company’s annual audit and related tax work for the year ended December 31, 2002. Seconded by Aronson and unanimously approved.

Meeting adjourned 6:40 p.m.

Required

a. How do you, as the auditor, know that all minutes have been made available to you?

b. Read the minutes of the meetings of February 16 and September 15. Use the following format to list and explain information that is relevant for the 2001 audit:

c.Read the minutes of the meeting of February 16, 2001. Did any of that information pertain to the December 31, 2000, audit? Explain what the auditor should have done during the December 31, 2000, audit with respect to 2001 minutes.

Step by Step Answer:

Auditing And Other Assurance Services

ISBN: 9780130091246

9th Canadian Edition

Authors: Alvin Arens, James Loebbecke, W Lemon, Ingrid Splettstoesser