The Pumpkin Patch is a franchise business operating retail stores for children's fashions. Tom and Wendy Koger

Question:

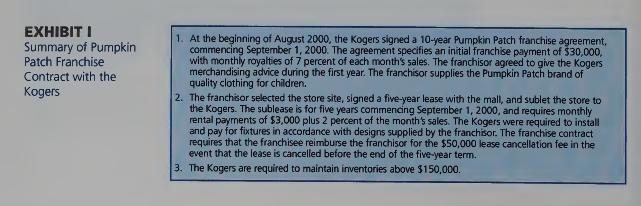

The Pumpkin Patch is a franchise business operating retail stores for children's fashions. Tom and Wendy Koger had no previous business experience when they answered an advertisement for a Pumpkin Patch franchise outlet in a large new shopping mall. The terms of the franchise contract signed by the Kogers are summarized in Exhibit I. The Kogers incorporated as Koger Limited (KL) on August 31, 2000, and opened their store on September 1, 2000. During fiscal 2000/01, KL's sales were consistently below the franchisor's forecasts. In early September 2001, when the bank manager refused to extend their line of credit, the Kogers arranged a luncheon meeting with Dan, a CA, to discuss their situation.

Dan: We met a year ago when you were seeking advice on acquiring the franchise. Was I of help to you?

Tom: We followed your advice on incorporating as one of our friends emphasized how important it was to have limited liability. But I decided that I could handle the bookkeeping on my microcomputer and that we would not need tax advice until we started making money. At the time, there seemed lit¬ tle point in seeing a lawyer as the franchisor had a standard "take it or leave it" franchise contract. (See Exhibit I.)

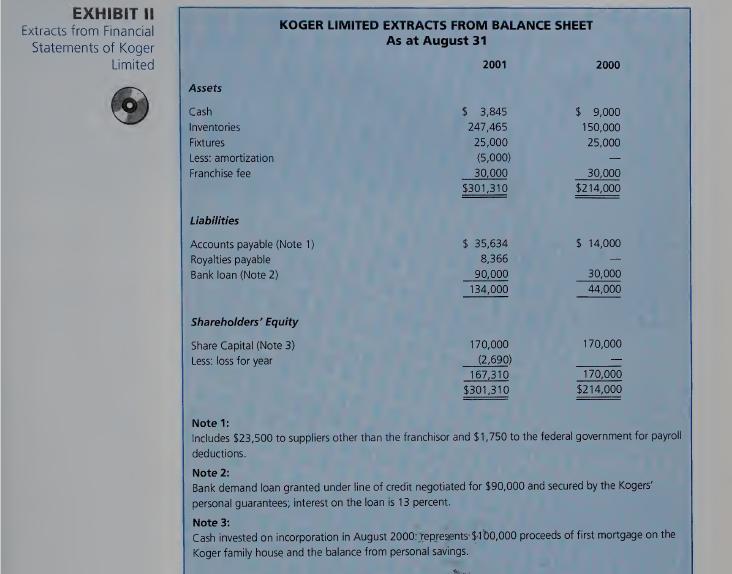

Wendy: We will soon have to place spring orders, and we are not sure whether to risk the money in additional inventory or throw in the towel now. I don't understand why we are having such severe cash problems when we are almost making a profit. I have nightmares about the bank manager calling in the demand loan. We both enjoy the business and would like to make a go of it.

Dan: Can I see your August 31, 2001, financial statements?

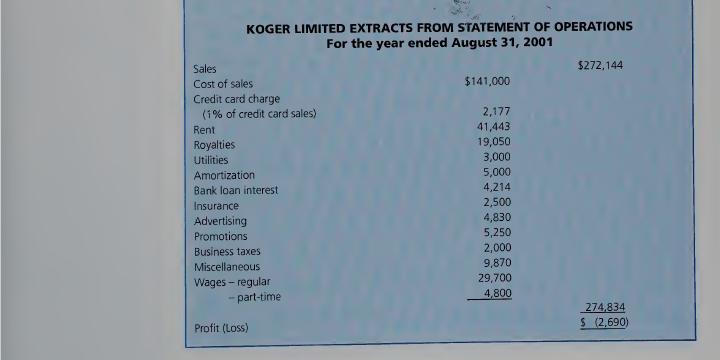

Tom: Here are the 2001 operating statement and balance sheet (see Exhibit II). Our sales fluctuate seasonally, with a large peak in December and smaller peaks in April and August. Our clearance sale in January produces sales second only to December. March, September, and October are slow months.

Dan: What then is the problem?

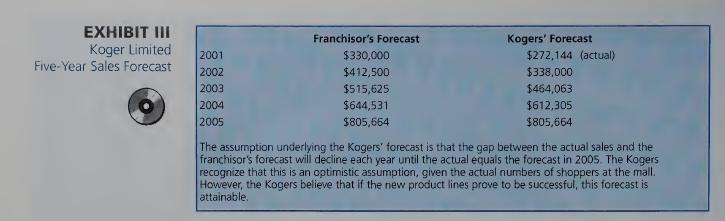

Wendy: Simply that every month we spend more than we collect, and we have not drawn any salaries ourselves. Part of the problem is that the purchase orders that the franchisor places for us have not sold well, so we are now placing our own orders. But the main problem is that the first-year sales that the franchisor forecasted for us were about 15 percent too high: the mall has not yet attracted many customers. Also, our store is just too large. We need at least three sales¬ people on average to attend to customers and inhibit pilfering.

Dan: What is your markup policy?

Tom: We have followed the franchisor's guideline of a 100 percent markup on purchase price. Our practice is to mark everything down 20 percent during clearance sales.

Dan: What markdown would it take to clear out your inventory?

Wendy: We would have to have a 50 percent-off sale to clear out about 80 percent, by value, of our inventory. But 50 per¬ cent would be madness since we would then be losing money.

Tom: Here are the franchisor's sales forecasts for the next five years, as well as our estimates based on the assumption that our new purchasing policy is a success and results in an increase in sales.

Dan: Let me look at the information, and I will prepare a report outlining my advice. First, I'll explain the process of cash flow management. Then, I'll outline alternative courses of action for you. Your business problems are pressing, so I won't worry about your tax situation now.

The franchisor has been unavailable to help the Kogers but has telephoned them several times about delays in making merchandise and franchise payments. During the last call, the possibility of the store's failing was discussed. In the event of failure, the franchisor stated that he would be prepared to take over ownership of the store and continue to manage the store but would pay only 65 percent of the cost for the year- end inventory. He considered much of the inventory ordered independently by the Kogers to be slow-moving. Any such payment would be net of anything owed to him by the Kogers. This sale would not be subject to the royalties and rental payments that are based on sales revenue. The Kogers would be reimbursed for the book value of the fixtures but would have to settle all outstanding liabilities.

Required Draft a report to the Kogers in which you

a. Explain the process of cash management.

b. Identify and analyze options available to them regarding their store.

Step by Step Answer:

Auditing And Other Assurance Services

ISBN: 9780130091246

9th Canadian Edition

Authors: Alvin Arens, James Loebbecke, W Lemon, Ingrid Splettstoesser