You are nearing completion of the 30 June 2015 audit of Goodies Ltd, a wholesaler of breakfast

Question:

You are nearing completion of the 30 June 2015 audit of Goodies Ltd, a wholesaler of breakfast foods and bakery supplies. Your manager has completed the working paper review and has compiled the following list of errors.

1. Sales cut-off at Melbourne branch was incorrect. Three invoices dated 1 July 2015 were processed with 30 June 2015 sales. These amounted to \($5600.\) Additional audit procedures confirmed there were no other cut-off errors. Mark-up is a standard 70% on cost price.

2. Year-end stocktake procedures revealed one stock line worth \($11,250\) was counted twice. The error was discovered and corrected by the client's accounting staff.

3. In order to carry out the debtors circularisation, the debtors ledger was divided into two parts:

i. All balances over \($8,000\). All these balances were circularised. The total value of the part was \($41,800\) .

ii. All other balances. A random sample of 15 of these balances was circularised. The total value of these balances was \($52,650\) .

Audit procedures revealed \($2510\) of overstatement errors in part (i). These errors were due to customers being invoiced for goods they didn't order. Mark-up is a standard 70 per cent on cost price. Audit procedures also revealed \($2080\) of overstatement errors in part (ii). The errors in part (ii) resulted from customers being billed twice. (The corresponding entry to inventory was correctly recorded only once.)

1. The loan confirmation from the bank revealed that interest payable for the month of June was\($5,200\) . The client has recorded an accrual of only \($4,200\) .

2. Audit procedures performed on related parties revealed one director-related transaction for \($1200\) was not disclosed in the draft notes to the financial statements.

3. A clerical error resulted in the June rent accrual of \($5600\) was mistakenly recorded as a noncurrent rather than a current liability.

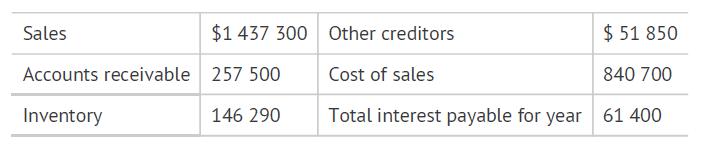

You also have the following balances from the draft financial statements:

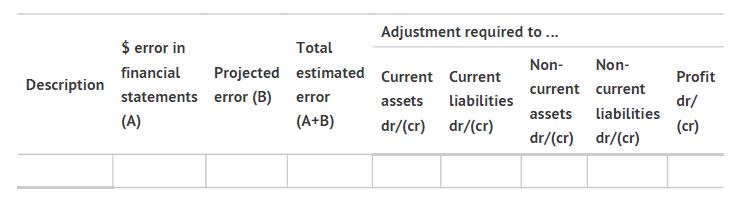

The manager has asked you to review the errors and prepare a summary workpaper that will enable her to assess whether the financial statements are materially misstated.

Required

a. What do the auditing standards require in relation to estimating the final dollar error in the financial statements before the signing of the audit opinion?

b. Using the above information, prepare a summary of audit differences workpaper for the audit manager.

c. Discuss how you would use the summary of audit differences workpaper in determining whether the financial statements are materially misstated.

Step by Step Answer:

Modern Auditing And Assurance Services

ISBN: 9781118615249

6th Edition

Authors: Philomena Leung, Paul Coram, Barry J. Cooper, Peter Richardson