You have been engaged to audit the financial statements of the Elliott Company for the year ended

Question:

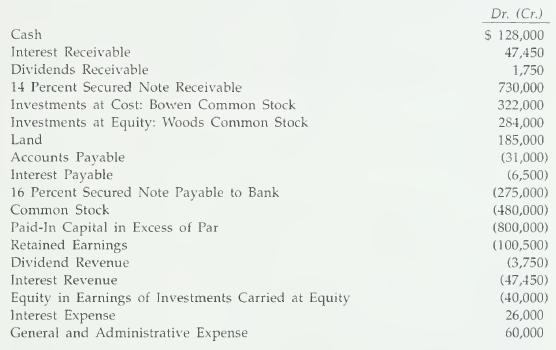

You have been engaged to audit the financial statements of the Elliott Company for the year ended December 31, 1999. You also audited the December 31, 1998 financial statements. Following is the December 31, 1999 trial balance:

You have obtained the following data:

a. The 14 percent note receivable is due from Tysinger Corporation and is secured by a first mortgage on land sold to Tysinger by Elliott on December 21, 1998. The note was to have been paid in 20 equal quarterly payments beginning March 31, 1999, plus interest. Tysinger, however, is in very poor financial condition and has not made any principal or interest payments to date.

b. The B.owen common stock was purchased for cash on September 21, 1998, in the market where the stock is traded actively. The stock is used as security for the note payable and is held by the bank. Elliott's investment in Bowen represents approximately 1 percent of Bowen's total outstanding shares.

c. Elliott's investment in Woods represents 40 percent of the outstanding common stock that is actively traded. Woods is audited by another auditor and has a December 31 year end.

d. Elliott neither purchased nor sold any equity investments during the year other than what's noted above.

Required:

For the following account balances, discuss: (1) the types of evidence you should obtain and (2) the audit procedures you should perform.

1. 14 Percent Secured Note Receivable.

2. Bowen Common Stock.

3. Woods Common Stock.

4. Dividend Revenue.

Step by Step Answer: