Question: a. Analysis and evaluation: Evaluate the effectiveness of the CIRI?s control environment. You may evaluate each individual component of the control environment but then develop

a. Analysis and evaluation: Evaluate the effectiveness of the CIRI?s control environment. You may evaluate each individual component of the control environment but then develop an overall conclusion regarding the control environment and its influence on other aspects of internal control.

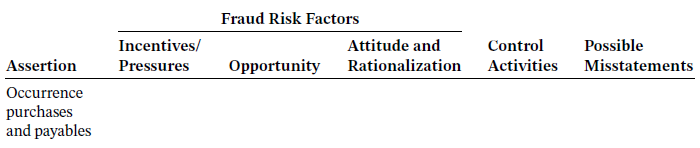

b. 1. Analysis and evaluation: Using the table below, evaluate the factors associated with the risk of fraud and the effectiveness of control activities with respect to the occurrence assertion for purchases and payables associated with the EDI purchasing system.

2. Analysis: Identify internal control deficiencies that you find in the EDI purchasing system.

c. Evaluation: Prepare a letter with the two most important internal control recommendations that you have for management. Each specific recommendation should describe the current system, explain the risk involved, and make specific recommendations for improvement. Focus on issues raised by the new system and not on issues that have been raised in prior audits.

Phase I: Company Background and Internal Control Evaluation Construction Industry Resources, Inc. (CIRI), a C corporation, supplies building material to contractors and construction sites in a major metropolitan area. Today, CIRI has approximately $60 million in total assets and generates approximately $250 million in annual revenues. Les Browning, the majority shareholder, purchased CIRI five years ago when sales were approximately $90 million per year and it was the only building supply business in the area. Les Browning owns 70% of CIRI, a business associate who is not active in the operation of the business owns 10% of the business, and two family members (Les Browning?s father and his brother) own 10% each. The other shareholders hold management positions in other businesses (not in the construction industry) and are not active in day-to-day management. Five years ago, Les owned only 55% of the business and he purchased 5% from each of the other shareholders based on an independent valuation of the business two years ago. Les plans to purchase 100% of the common stock outstanding sometime in the next five years. Les has prided himself on his ability to grow sales and profits of the company and he looks forward to another 10 to 15 years of running the company, and enjoying the benefits of ownership, before considering an exit strategy and retirement.?

The board of directors is composed of the four shareholders, a representative of CIRI?s major lender, the corporation?s attorney, and its controller, Craig Ferris. The board of directors meets semiannually to review the company?s performance and make decisions regarding officer bonuses and dividends. Unlike public companies, CIRI does not have an audit committee. An audit is needed for the bank and other creditors, and the auditor meets annually with the board as a whole.

CIRI is composed of two major divisions. One division is involved in the purchase and sale of lumber, building materials, hardware, and related products. The other division is a lumber brokerage business. The building supply division competes in a very competitive business environment where business must be earned on both price competitiveness and on quality of service. The building supply division has three retail/wholesale outlets in a major metropolitan area of approximately 2 million people. The lumber brokerage business is also extremely price-competitive. As a result, the company operates on relatively high ratios of sales to total assets (high asset turnover), and profit margins are low.

When Les came to CIRI, he had a strong sales background. He therefore focused his attention first on customer relations and building sales in the building supply business, paying attention to CIRI?s relationships with the major general contractors and builders in the community. Les knew that profit margins were going to be thin, so he focused his energies on growing sales volume. Then, three years ago, he decided to launch the lumber brokerage division, which allowed CIRI direct access to lumber markets as well as allowed the company to continue a strong growth trend in total revenues.

Craig Ferris has been CIRI?s controller for 30 years, and he continued with the company when Les Browning and the other shareholders acquired it. Les is comfortable with Craig?s skills and knows thathe will have to increase the salary for the position to hire a replacement when Craig retires. Craig, while not a CPA, has a competent understanding of GAAP and knows many of the suppliers and general contractors in the construction business. In addition to completing monthly income statements and balance sheets for the company, Craig has paid a great deal of attention in recent years to the lumber brokerage business, particularly to understanding and attempting to control the business risks associated with price volatility in the lumber markets.

Craig also reviews each store?s overall performance when the financial statements are prepared each month, but the company does not have sufficient staff or time to develop budgets. Accountability for store performance is very informal. Store managers are paid competitive salaries, but they receive no bonuses. Therefore, accounting numbers do not play in the determination of store managers? compensation packages. Further, Craig and Les feel that it would be too time-consuming to develop budgets that reflect the seasonal nature of the business, and they feel that interim financial statements are sufficient to control the business.

You have been assigned to the audit of the building supplies division, specifically the purchasing process, which consists primarily of the acquisition of inventories (many of which are delivered directly to building sites), the inventory process, and accounts payable. Information and Communication and Control Activities

With respect to the accounting system and control activities, Les has been rather hands-off, focusing his attention on sales growth and lumber brokerage. Les has been satisfied with Craig?s ability to produce income numbers within 15?20 days after month-end, and he has relied on the annual audit to ensure that the accounting system is working correctly. In past audits, Les and Craig have accepted auditor-proposed journal entries related to the allowance for doubtful accounts and inventory shrinkage (a perpetual problem in the construction industry), but routine transactions have not resulted in significant audit problems.

Three ongoing issues have been raised in prior management letters:

1. There is a segregation of duties problem in cash disbursements as Craig has access to the supply of unused checks, he signs checks, and he performs the monthly bank reconciliations.

2. A similar segregation of duties issue has been raised regarding the activities of Wendy Roberts, who authorizes credit, maintains accounts receivable records, and follows up on bad debts. However, Craig has responsibility for writing off bad debts.

3. There is no formal system and review associated with adding new vendors or new customers to master vendor and customer files.

Les and the other owners have not taken action on these issues as no significant audit adjustments have been proposed related to these problems that they believe are due to a company with a small accounting staff. The owners have viewed the audit adjustments to the allowance for doubtful accounts as an issue where they welcome the oversight provided by outside auditors.

A major change in the accounting system was planned last year and implemented at the beginning of the current year (2022) when one of CIRI?s major suppliers, Contractors Wholesale Supply (CWS), approached CIRI about implementing a purchasing system with electronic data interchange (EDI). Les was eager to move forward with the system as it would keep CIRI on the cutting edge. In general, the EDI system allows CIRI to order goods electronically. CWS sends electronic sales invoices, and CIRI makes weekly payments by electronic funds transfer through a bank where both CWS and CIRI have accounts. Les sees that the process expedites shipments to customers, and CIRI receives a 1% discount on all shipments ordered through the system. Craig was also willing to make the change, as a significant portion of the operating system was resident with the supplier, and only modest programming changes were necessary at CIRI.

Craig delegated implementation of the EDI system to Dennis Brewer. Dennis has been with the company for several years and has demonstrated strong technology skills. Dennis is also responsible for accounts payable and accounting for inventories. Dennis looks at the systems project as a real opportunity to demonstrate his skills. Dennis has been disappointed that he has not advanced faster in the organization. He has commented to colleagues about his frustration that most of his college friends have achieved management roles in their jobs, and they are earning good salaries and bonuses. Dennis has several children in private school and feels that this is his opportunity to earn advancement, status, and the salary he wants and needs.

Following is a brief description of how the new EDI purchasing system functions at CIRI: Initiating purchases. Several buyers are responsible for purchasing inventory, managing store inventories, and making sales to general contractors and the larger builders in the metropolitan area. The buyers determine inventory to order based on their review of inventory on hand and requests from customers.

Based on perceived inventory needs, the buyer can log onto the CSW/CIRI system using passwords, and electronically place a CIRI prenumbered purchase order directly with CWS online in real time. CWS confirms the order electronically, and an electronic sales order is sent from CWS to Dennis. Dennis receives exception reports each morning of any mismatches between CIRI purchase orders and CWS sales orders. (CWS writes sales orders based on inventory that they have in stock.) Dennis tracks all purchases based on the prenumbered purchase orders. Buyers have restricted access to only the order side of the system. (Buyers can also monitor all inventory quantities.) Receiving access has been given only to the warehouse clerks at each store. Dennis has full access to the system.

Receiving goods. When shipments are received from CWS, they are counted by the warehouse clerk at each of CIRI?s three stores. The clerk then logs into the CWS/CIRI system and enters quantities received in the electronic equivalent of a prenumbered receiving report. The electronic receiving report is sent from each store to Dennis. Further, approximately 35% of purchases are drop-shipped directly to customer locations. In other words, a building contractor will call a CIRI buyer, who will order the goods from CWS and have them shipped directly to the building site. The warehouse clerk at each store has responsibility for following up on drop shipments with customers and filing electronic receiving reports for drop shipments. Experience shows that this is a low priority for these warehouse clerks, and it often takes nagging by Dennis each week to get these reports filed. This had also been a problem in the manual

system in that on-site project managers were not good about signing delivery reports. When the warehouse clerk at the responsible store files an electronic receiving report for drop shipments, the clerk also has responsibility for filing a shipping report to initiate CIRI?s customer billing process. The receiving information updates the perpetual inventory records for all items received at one of the three stores. The perpetual inventory is not updated for drop shipments. The buyers informally review the accuracy of the perpetual inventory for reasonableness. A full physical inventory is done at year-end, and the stores are closed for that event.

Recording payables. When CWS ships goods, an invoice is electronically sent to Dennis. Each day, Dennis receives a system-generated report of items that have been ordered from CWS, a report of items ordered that have not been received, and a list of all billings that have not been matched with prenumbered receiving reports. Dennis pays the most attention to these reports on Wednesdays and Thursdays so that all billings are cleared for electronic payment on Friday. He particularly follows up on items where electronic invoices have been received from CWS that have not yet been matched with receiving reports sent from the stores. He then files these exception reports by date with his notations on the various reports. Once the electronic receiving report is electronically matched with the sales invoice, a payable is established and Dennis approves payment of the invoice.

Electronic funds transfer. Every Friday, the total of approved invoices is paid via electronic funds transfer though a national bank from CIRI to CWS. Craig is responsible for reviewing and approving a list of cash disbursements before they are run. With respect to the EDI system, Craig performs an overall reasonableness check on the volume of activity with CWS.

Craig feels that the system has greatly reduced the paperwork, made the office more efficient, and allowed the company to maintain margins in a very competitive marketplace. Dennis was happy to work on the project and was pleased to be given the increased responsibility. However, Dennis was overheard in the lunchroom to have been disappointed that neither pay nor promotion advances were received as he expected, and that he is not earning what he deserves. Dennis expressed frustration that his career was going nowhere and that Craig and Les were too tight-fisted with promotion and recognition for making the transition go smoothly.

Fraud Risk Factors Incentives/ Pressures Attitude and Rationalization Possible Misstatements Control Activities Assertion Opportunity Occurrence purchases and payables

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

This case allows the professor to explore the challenges of auditing privately held companies While privately held companies do not receive the same attention of public companies they represent a sign... View full answer

Get step-by-step solutions from verified subject matter experts