During your audit of the financial statements of the Dolomite Corporation for the year ended December 31,

Question:

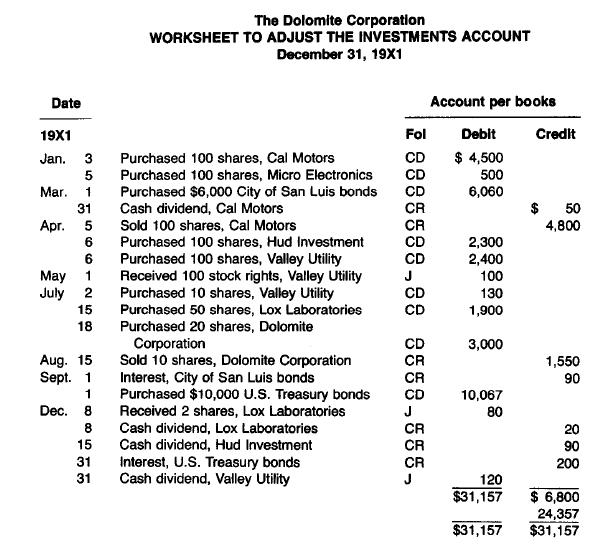

During your audit of the financial statements of the Dolomite Corporation for the year ended December 31, 19X1, you determine that the company's surplus funds have been temporarily invested in securities. The company's books are maintained on the accrual basis. A transcript of the investments account is shown.

The following information and data were developed from your audit procedures:

1. The City of San Luis bonds were purchased as a new issue. No accrued interest was purchased. 2 The 100 Valley Utility rights were recorded at the May I quoted price on the stock exchange. (The credit of the journal entry was to miscellaneous income.) The stock was quoted at $19 per share ex-rights on May 1. For each five rights held, one share of Valley Utility stock could be purchased at $13 per share. The company exercised rights to buy 10 shares on July 2, when the market price was $16 per share. The rights expired on August 15.

3. The Dolomite Corp. purchased 20 shares of its own stock from the estate of a deceased stockholder. The stock has a par value of $100 and was originally issued for $115 per share. Of the 20 shares 10 were sold to an officer of the company for $155 per share. 4 In August Micro Electronics was reorganized. The original issue of stock was eliminated. New common stock was issued to bondholders and other creditors. 5 The purchase price of the U.S. Treasury bonds included accrued interest of $67. 6 During December Lox Laboratories declared a 5 percent stock dividend. In lieu of fractional shares cash was distributed based on the current market price of $40 per share. (The credit of the journal entry was to miscellaneous income.)

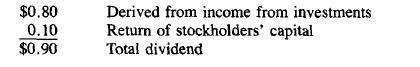

7 The Hud Investment Co. letter accompanying its annual dividend check gave the following composition of the dividend:

8 On December 15 Valley Utility declared a cash dividend of $1 per share payable on January 15, 19X2, to stockholders of record of December 29, 19X1. (The credit of the journal entry was to miscellaneous income.)

9. The securities are kept in a safe deposit box. You examined the securities on January 8, 19X2, after determining from the bank's records that the last entry to the box was on December 8. All securities were examined and properly accounted for.

Prepare a worksheet showing the adjustments to arrive at the corrected balance in the investments account at December 31, 19X1, and other adjustments or reclassifications arising from your audit of the account. Your worksheet should include the names of other accounts affected by the adjustments or reclassifications. (Formal journal entries are not required.) The books have not been closed.

Step by Step Answer:

Auditing Concepts And Methods A Guide To Current Auditing Theory And Practice

ISBN: 9780070099999

5th Edition

Authors: Mcgraw-Hill