In 19X1, Reid, who had been in the lumbering business for many years, incorporated his business as

Question:

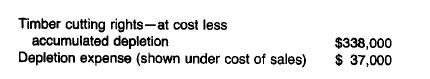

In 19X1, Reid, who had been in the lumbering business for many years, incorporated his business as Reid Ltd. Reid became president of the company and Zilker, the chief accountant, was appointed treasurer. Zilker continued to be responsible for the accounting and each year prepared financial statements and the company's tax returns. The company's accounts were never audited. In late 19X8, however, the company applied for a bank loan and was informed that audited financial statements for the year ended December 31, 19X8, would have to be submitted. Prior to the incorporation of his business, Reid had accumulated some timber- cutting rights, which were sold to the company upon incorporation. The company has since acquired further cutting rights. Zilker recorded all cutting rights at cost as a noncurrent asset and charged to expense each year a depletion allowance on the rights. The December 31, 19X8, financial statements as prepared by Zilker include the following amounts with respect to the cutting rights:

List the audit procedures the auditor might apply to substantiate the timber cutting rights asset and depletion expense.

Step by Step Answer:

Auditing Concepts And Methods A Guide To Current Auditing Theory And Practice

ISBN: 9780070099999

5th Edition

Authors: Mcgraw-Hill