You have performed an audit, in conformity with generally accepted auditing standards, of the financial statements of

Question:

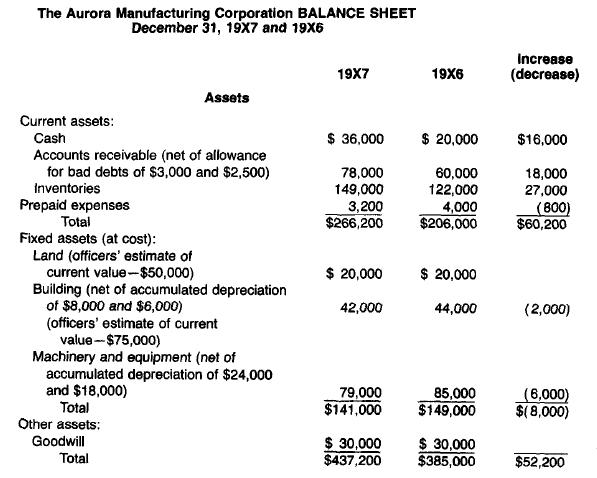

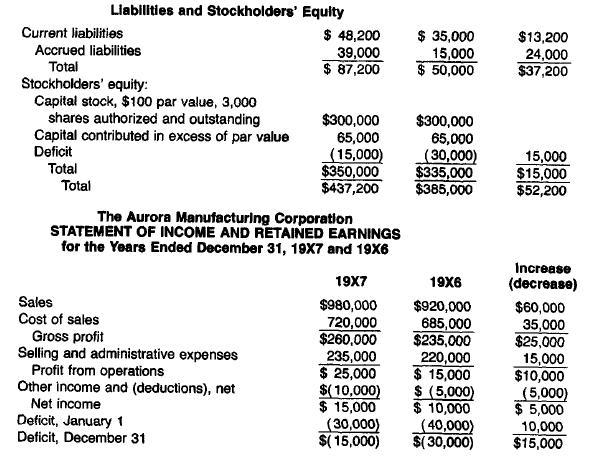

You have performed an audit, in conformity with generally accepted auditing standards, of the financial statements of the Aurora Manufacturing Corporation for the year ended December 31, 19X7. These statements, together with those for 19X6 in comparative form (the Statement of Cash Flows has been omitted to save space) are presented. This is your first audit of the company and you satisfied yourself regarding the opening inventory and the consistency of the application of accounting principles. Your work papers contain the following notes:

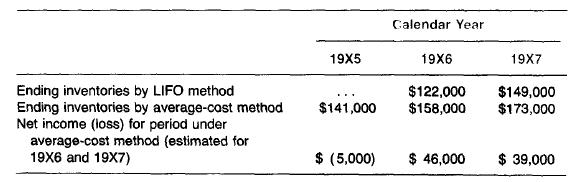

1. In the prior year, 19X6, the company changed its method of costing inventories from the average-cost method to the LIFO method. The average-cost method had been used consistently in prior years. The information shown at the top of page 526 was developed.

2. A new highway will be constructed through the general area in which the company's building is located. The exact route of the highway will not be established for 6 months, and highway officials refuse to disclose their current plans other than that the building might be in the path of the highway. The officers' estimate of the value of the land and building is the amount for which they expect to sell

the property to the highway department. Because of the indefinite location of the highway, there have been no recent sales of property in the general area, and real estate appraisers are not in agreement on the value of the property.

3. The intangible asset is the total cost of the company's institutional advertising campaign that took place in 19X2 when the company began doing business. The officers believe that the company is continuing to benefit from the goodwill developed by the campaign, and they intend to write off the asset when it becomes reasonably evident that it is worthless.

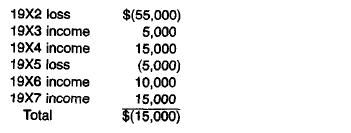

4. An analysis of the deficit follows:

No entries have been posted to the deficit account other than the above results of operations, which are in agreement with the income tax returns. The tax returns have not been examined. Management has decided that reporting the value of the carryforward loss in the balance sheet would not be conservative. Management prefers not to change the financial statements in any way but will consider adding notes. The income tax rate that has been in effect is 50 percent.

1. Prepare the notes that you would suggest for the financial statements.

2. Assuming that the suggested notes will be adopted and that a statement of cash flows will be appropriately presented, prepare your audit report for the current year financial statements. Include in your report any comments that you consider necessary. If your report is in any way modified or qualified as to opinion, give a full explanation in your report.

Step by Step Answer:

Auditing Concepts And Methods A Guide To Current Auditing Theory And Practice

ISBN: 9780070099999

5th Edition

Authors: Mcgraw-Hill