Some economists have proposed that central banks should use the following rule for choosing their target interest

Question:

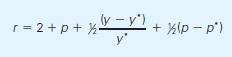

Some economists have proposed that central banks should use the following rule for choosing their target interest rate (r):

where:

p is the average of the inflation rate over the past year y is real GDP as recently measured y * is an estimate of the natural rate of output p* is the central bank’s target rate of inflation which is given as 2 per cent.

a. Explain the logic that might lie behind this rule for setting interest rates. Would you support the use of this rule?

b. Some economists advocate such a rule for monetary policy but believe p and y should be the forecasts of future values of inflation and output. What are the advantages of using forecasts instead of actual values? What are the disadvantages?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: