3. Jurgen-Strut of Germany. Jurgen-Strut (JS) is a German-based company that manufactures elec- tronic fuel-injection carburetor assemblies

Question:

3. Jurgen-Strut of Germany. Jurgen-Strut (JS) is a German-based company that manufactures elec- tronic fuel-injection carburetor assemblies for sev- eral large automobile companies in Germany, including Mercedes, BMW, and Opel. The firm, like many firms in Germany today, is revising its financial policies in line with the increasing degree of disclo- sure required by firms if they wish to list their shares publicly in or out of Germany.

JS's primary problem is that the German corpo- rate income tax code applies a different income tax rate to income depending on whether it is retained (45%) or distributed to stockholders (30%).

a. If Jurgen-Strut planned to distribute 50% of its net income, what would be its total net income and total corporate tax bills?

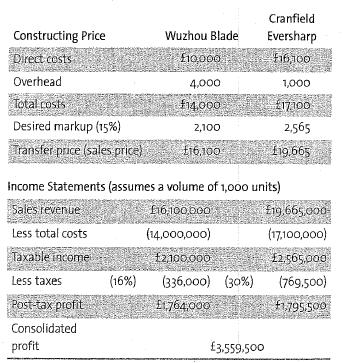

b. If Jurgen-Strut was attempting to choose between a 40% and 60% payout rate to stockholders, what arguments and values would management use in order to convince stockholders which of the two payouts is in everyone's best interest? Wuzhou Blade Company. Use the following company case to answer Problems 4 through 6. Wuzhou Blade Company (Hong Kong) exports razor blades to its wholly owned parent company, Cranfield Eversharp (Great Britain). Hong Kong tax rates are 16% and British tax rates are 30%. Wuzhou calculates its profit per container as follows (all values in British pounds):JS's primary problem is that the German corpo- rate income tax code applies a different income tax rate to income depending on whether it is retained (45%) or distributed to stockholders (30%).

a. If Jurgen-Strut planned to distribute 50% of its net income, what would be its total net income and total corporate tax bills?

b. If Jurgen-Strut was attempting to choose between a 40% and 60% payout rate to stockholders, what arguments and values would management use in order to convince stockholders which of the two payouts is in everyone's best interest? Wuzhou Blade Company. Use the following company case to answer Problems 4 through 6. Wuzhou Blade Company (Hong Kong) exports razor blades to its wholly owned parent company, Cranfield Eversharp (Great Britain). Hong Kong tax rates are 16% and British tax rates are 30%. Wuzhou calculates its profit per container as follows (all values in British pounds):

Step by Step Answer:

Fundamentals Of Multinational Finance

ISBN: 9780321541642

3rd Edition

Authors: Michael H. Moffett, Arthur I. Stonehill, David K. Eiteman