3.29. It is now October 2016. A company anticipates that it will purchase 1 million pounds of...

Question:

3.29. It is now October 2016. A company anticipates that it will purchase 1 million pounds of copper in each of February 2017, August 2017, February 2018, and August 2018. The company has decided to use the futures contracts traded by the CME Group to hedge its risk. One contract is for the delivery of 25,000 pounds of copper. The initial margin is $2,000 per contract and the maintenance margin is $1,500 per contract. The company’s policy is to hedge 80% of its exposure. Contracts with maturities up to 13 months into the future are considered to have sufficient liquidity to meet the company’s needs. Devise a hedging strategy for the company. (Do not make the adjustment for daily settlement described in Section 3.4.)

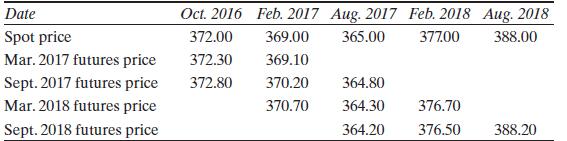

Assume the market prices (in cents per pound) today and at future dates are as in the following table. What is the impact of the strategy you propose on the price the company pays for copper? What is the initial margin requirement in October 2016? Is the company subject to any margin calls?

Step by Step Answer: