6. Tostadas de Baja, S.A. Tostadas de Baja, S.A., located in the state of Baja California, Mexico,...

Question:

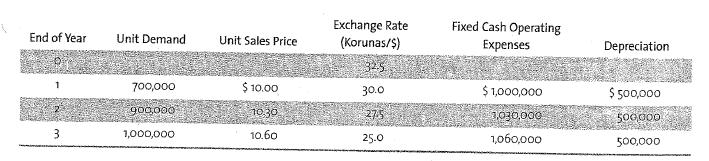

6. Tostadas de Baja, S.A. Tostadas de Baja, S.A., located in the state of Baja California, Mexico, man- ufactures frozen Mexican food, which enjoys a large following in California and Arizona to the north. In order to be closer to its U.S. market, Tostadas de Baja is considering moving some of its manufactur- ing operations to southern California. Operations in California would begin in 2003 and have the follow- ing attributes:

a. The 2003 sales price in the United States would average $5 per package, and prices would increase 3% per annum.

b. 2003 production and sales would be 1 million packets. Unit sales would grow at 10% per annum.

e. California production costs of an estimated $4 per packet in 2003 would increase by 4% per annum. General and administration expenses would be $100,000 per year. Depreciation expenses would be $80,000 per year.

d. Tostadas de Baja uses a weighted average cost of capital of 16%.

e. Tostadas de Baja will assign an after-tax value to its California plant at the end of 2005 equal to an infinite stream of 2005 dividends, discounted at 20% per annum. The higher discount rate is because the company is concerned about the

political risk of a Mexican firm manufacturing in California.

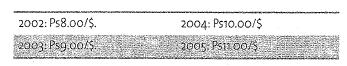

f. All production is for sale; hence, production vol- ume equals sales volume. All sales are for cash. g. Combined federal and state tax rate is 30% in the United States and 25% in Mexico. h. Actual and expected exchange rates, by year, are as follows:

The California vineyard will pay 80% of its accounting profit to Tostadas as an annual cash divi- dend. Mexican taxes are calculated on grossed up dividends from foreign countries, with a credit for host country taxes already paid. What is the maxi- mum U.S. dollar price Tostadas de Baja should offer in 2003 for the investment? Santa Clara Electronics. Use the following problem and assumptions to answer questions 7-10. Santa Clara Electronics, Inc., of California exports 24,000 sets of low-density light bulbs per year to Argentina under an import license that expires in five years. In Argentina the bulbs are sold for the Argentine peso equivalent of $60 per set. Direct manufacturing costs in the United States and shipping together amount to $40 per set. The market for this type of bulb in Argentina is stable, neither growing nor shrinking, and Santa Clara holds the major portion of the market.

The Argentine government has invited Santa Clara to open a manufacturing plant so imported bulbs can be replaced by local production. If Santa Clara makes the investment, it will operate the plant for five years and then sell the building and equipment to Argentine investors at net book value at the time of sale plus the value of any net working capital. (Net working capital is the amount of current assets less any portion financed by local debt.) Santa Clara will be allowed to repatriate all net income and depreciation funds to the United States each year. Santa Clara traditionally evaluates all foreign investments in U.S. dollar terms. Investment. Santa Clara's anticipated cash outlay in US dollars in 2003 would be:

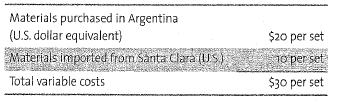

All investment outlays will be made in 2003, and all operating cash flows will occur at the end of years 2004 through 2008. Depreciation and Investment Recovery. Building and equipment will be depreciated over five years on a straight-line basis. At the end of the fifth year, the $1,000,000 of net working capital may also be repatri- ated to the United States, as may the remaining net book value of the plant. Sales Price of Bulbs. Locally manufactured bulbs will be sold for the Argentine peso equivalent of $60 per set. Operating Expenses per Set of Bulbs. Material pur- chases are as follows:

Transfer Prices. The $10 transfer price per set for raw material sold by the parent consists of $5 of direct and indirect costs incurred in the United States on their manufacture, creating $5 of pre-tax profit to Santa Clara. Taxes. The corporate income tax rate is 40% in both Argentina and the United States (combined federal and state/province). There are no capital gains taxes on the future sale of the Argentine subsidiary, either in Argentina or the United States. Discount Rate. Santa Clara Electronics uses a 15% discount rate to evaluate all domestic and foreign projects.

Step by Step Answer:

Fundamentals Of Multinational Finance

ISBN: 9780321541642

3rd Edition

Authors: Michael H. Moffett, Arthur I. Stonehill, David K. Eiteman