(Average compounding rate) WindyRoad is an investment company which has two mutual funds. The WindyRoad Dull Fund...

Question:

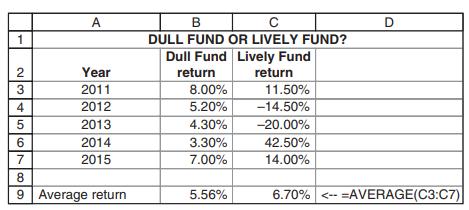

(Average compounding rate) WindyRoad is an investment company which has two mutual funds. The WindyRoad Dull Fund invests in boring corporate bonds, and its Lively Fund invests in “high-risk, high-return” companies. The returns for the two funds in the 5-year period 2011–2015 are given below.

a. Suppose you had invested $100 in each of the two funds at the beginning of 2011. How much would you have at the end of 2015?

b. What was the effective annual interest rate (EAIR) paid by each of the funds over the 5-year period 2011–2015?

c. Is there a conclusion you can draw from this example?

(Advanced section)

d. Compute the annual continuous returns for Dull Fund and Lively Fund for each of the years 2011–2015. What is the average continuous return raverage continuous for each fund (reminder: value value e t t rt continuous = −1 * )?

e. Suppose you had invested $100 in each of the two funds at the beginning of 2011. Show that the total amount you would have in each fund (see part

a) can be written as $ * * 100 5 e raverage continuous . Notice that this makes computations much simpler.

Step by Step Answer:

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi