(Covered call) A covered call position entails entering into a long position in stock and writing a...

Question:

(Covered call) A covered call position entails entering into a long position in stock and writing a call option with a high strike price. The purpose of such a position is to finance a portion of the stock purchase from the sale of the call option.

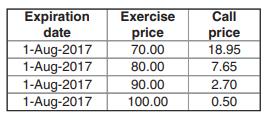

Sam thinks that STF Corporation stock, currently priced at $80/share, will go up in price by about $15 in the next 6 months. He would like to buy 10,000 shares of STF today and cash in on his bullish sentiment. In order to cut the initial costs of his purchase, he would like to enter into a covered call position. The following options are traded on STF Corporation:

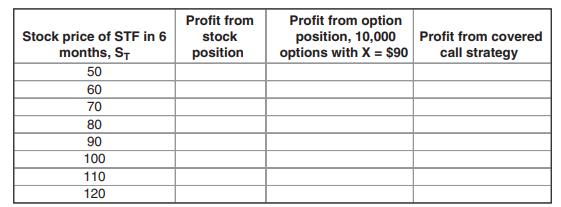

Suppose Sam writes 10,000 of the $90 calls.

a. Show Sam’s profit. Use the following template:

b. Compare the profits from a covered call strategy using the $90 calls with one using the $100 calls.

c. Which of the two covered call strategies would you recommend?

Step by Step Answer:

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi