(Do this example only if youve studied Chapter 1720 on option pricing.) The BlackScholes option pricing model,...

Question:

(Do this example only if you’ve studied Chapter 17–20 on option pricing.)

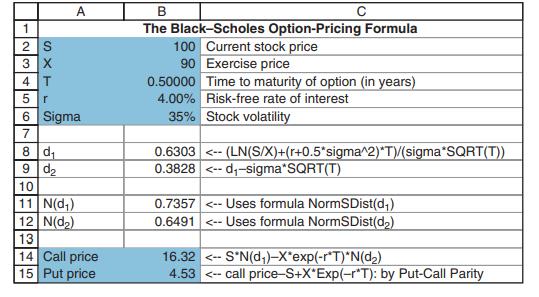

The Black–Scholes option pricing model, defined in Chapter 19, prices call and put options based on five parameters:

• S, the stock price today

• X, the option’s exercise price (also called the option’s strike price)

• T, the option’s expiration date

• r, the interest rate

• σ (“Sigma”), the riskiness of the stock These inputs and the resulting call and put prices are highlighted below.

Your assignment: Use Data Table to create tables showing the sensitivity of the call and put prices to the various inputs. Here are some suggestions:

a. Using the parameters shown below, what are the call and put prices given σ = 10%, 15%, 20%, . . ., 80%?

b. Using the parameters shown below, what are the call and put prices when T = 0.1, 0.2, 0.3, . . ., 1?

Step by Step Answer:

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi