(Jensens alpha) The risk-free rate is 2%. You observe two fund managers (A and B) and the...

Question:

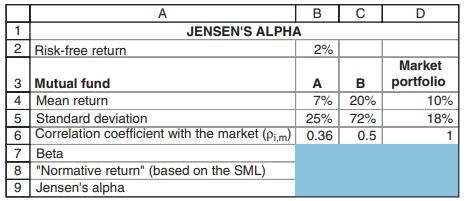

(Jensen’s alpha) The risk-free rate is 2%. You observe two fund managers (A and B) and the market portfolio.

a. Calculate the beta of each stock and the market portfolio.

b. Calculate the “Normative return” based on the SML for each stock and the market portfolio.

c. Calculate Jensen’s alpha for each stock and the market portfolio.

Transcribed Image Text:

A B C D 1 JENSEN'S ALPHA 2 Risk-free return 2% Market 3 Mutual fund A B portfolio 4 Mean return 7% 20% 10% 5 Standard deviation 25% 72% 18% 6 Correlation coefficient with the market (pi,m) 0.36 0.5 1 7 Beta 8 "Normative return" (based on the SML) 9 Jensen's alpha

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi

Question Posted:

Students also viewed these Business questions

-

Suppose you have been given the following set of data representing the test scores of 10 college algebra students 78 92 85 67 88 94 72 90 79 81 a Calculate the mean of the test scores of the students...

-

Recall Blades Inc. that is a famous producer of Speedos established a subsidiary in Thailand to manufacture roller blades.This subsidiary of Blades, Inc., just received a special order for 120,000...

-

Using classical conditioning terminology, explain how you think this phobia could have been learned. If you do not know exactly how the phobia was learned, it is ok to speculate. Be sure to identify...

-

Consider the case of the Cisco Fatty. Who was wrong? Advise how a firm might best handle this kind of online commentary.

-

Suppose that we will take a random sample of size n from population having mean fx and standard deviation a. For each of the following situations, find the mean, variance, and standard deviation of...

-

Which loop should you use in situations where you want the loop to repeat until the boolean expression is false, and the loop should not execute if the test expression is false to begin with?

-

Foxboro Company expects to pay a $2.30 per share cash dividend this year on its common stock. The current market value of Foxboro stock is $32.50 per share. Compute the expected dividend yield on the...

-

The assembly department has the following production and cost data for the current month. Materials are entered at the beginning of the process. The ending work in process units are 70% complete as...

-

mework Saved Help 18 Purchased $5,500 of merchandise from Frist Corp. with credit terms of 1/10, n/30. Invoice dat FOB destination. 21 After negotiations, received from Prist a $500 allowance toward...

-

(Treynor ratio) Apple stock has a beta of 1.27, the risk-free rate of return is 1.5%, and Apples mean return is 67.28%. What is the Treynor ratio of Apple?

-

(Jensens alpha) Thomas manages an investment firm. His firms investments have beta of 0.7. The market risk premium is 6%, and the risk-free rate in the economy is 2%. Thomas presents you the...

-

Match each equation in Exercises with its graph in (a)(f) below and in the next column. x 2 - y 2 = z (a) (b) (c) (d) (e) (f) N Z

-

Using the definitions of even integer and odd integer, give a proof by contraposition that this statement is true for all integers n: If 5n+3 is even, then n is odd.

-

7. Design the formwork for a wall 8-ft (2.44-m) high to be poured at the rate of 5 ft/h (1.53 m/h) at a temperature of 77F (25C). The concrete mixture will use Type I cement without retarders and is...

-

tempt in Progress The City of Minden entered into the following transactions during the year 2026. 1. A bond issue was authorized by vote to provide funds for the construction of a new municipal...

-

Q Proprietorinc (the lessee) enters into a 10 year lease of a property with an option to extend the contract for 5 years. Lease payments are $50,000 per year, payable at the beginning of each year....

-

1.Think about your investment Possibility for 3 years holding period in real investment environment? A.What could be your investment objectives? B. What amount of fund you could invest for three...

-

Seaside Inc. recorded the following transactions over the life of a piece of equipment purchased in 2013: Jan. 1, 2013 Purchased the equipment for $38,000 cash. The equipment is estimated to have a...

-

Sportique Boutique reported the following financial data for 2012 and 2011. Instructions(a) Calculate the current ratio for Sportique Boutique for 2012 and 2011.(b) Suppose that at the end of 2012,...

-

What is Coke's average ownership percentage in its equity method investments? Goodwill is 7000 Calculate the firm's current ratio (current assets/current liabilities). Calculate the current ratio...

-

John has to choose between Project A and Project B, which are mutually exclusive. Project A has an initial cost of $30,000 and an internal rate of return of 16 percent. Project B has an initial cost...

-

Complete the table below, for the above transactions

Study smarter with the SolutionInn App