(Market portfolio, CML) In the Golkoland stock market, there are only two listed stocks, Xirkind and Yirkind....

Question:

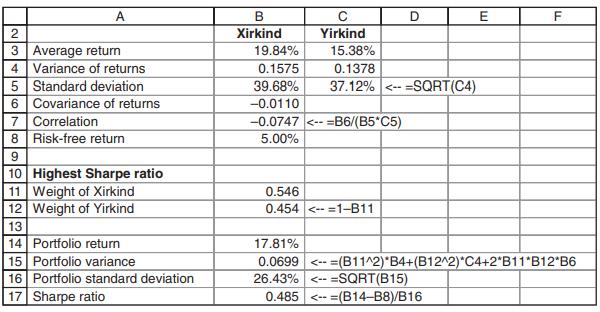

(Market portfolio, CML) In the Golkoland stock market, there are only two listed stocks, Xirkind and Yirkind. The risk-free rate of return in Golkoland is 5%, and the portfolio of Xirkind and Yirkind stocks which has the highest Sharpe ratio is given below:

a. What is the market portfolio M in Golkoland?

b. What is the equation of the capital market line (CML) in Golkoland?

c. What does the CML mean, and why are we interested in it?

d. What is the expected return and standard deviation of a portfolio composed of 30% of the risk-free asset and 70% of the market portfolio?

e. Suppose an investor wants the same return as the above portfolio (part

d) but invests only in the risk-free asset and a portfolio composed of equal weights of Xirkind and Yirkind stocks. What will be the standard deviation of the returns of his portfolio? How do you explain the difference in standard deviations between this question and in part d?

Step by Step Answer:

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi