(Mean and variance portfolio of two risky assets and a risk-free asset) Consider the following data for...

Question:

(Mean and variance portfolio of two risky assets and a risk-free asset)

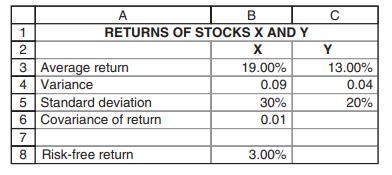

Consider the following data for stocks X and Y and a risk-free asset:

a. What is the return and standard deviation of the minimum variance portfolio of stocks X and Y?

b. What is the return and standard deviation of a portfolio composed of 30% of the minimum variance portfolio and 70% of the risk-free asset? Repeat this question with weights of 50% for the risk-free asset and the minimum variance portfolio.

c. Mary Jones asks you to create a portfolio composed of the risk-free asset and the minimum variance portfolio. Mary wants an expected return of 9%. What will the percentage of the portfolio invested in the risk-free asset and in the minimum variance portfolio?

d. Kaid Benfield wants a portfolio composed of the risk-free asset and the minimum variance portfolio. Find a portfolio for Kaid that has a standard deviation of returns of 5%.

Step by Step Answer:

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi