(NPV, IRR, EAC, PI, challenging) Your company is considering an investment in the following projects (cash flows...

Question:

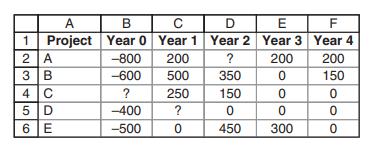

(NPV, IRR, EAC, PI, challenging) Your company is considering an investment in the following projects (cash flows are in thousand dollars).

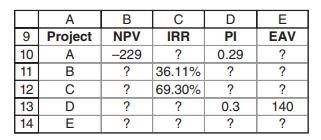

The CFO of your company has calculated the following values for the projects:

Assume the following:

• All cash flows presented in the table are received on the last day of the year.

• You can invest in fraction of projects—for example, you can invest half of the cost and receive half of the cash flows.

• All the projects carry the same risk and should be discounted with the same discount rate.

Answer the following questions:

a. Use Project D to show that the discount rate (cost of capital) is 16.67%

per annum.

b. Complete the missing values from the table.

c. Which project should the company choose if the projects are mutually exclusive?

d. Which project should the company choose if the projects are not mutually exclusive and the company faces a $1,000K budget constraint?

Step by Step Answer:

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi