(Profit margin from two put options) On 16 May 2015 McDonalds (MCD) stock is trading at $98...

Question:

(Profit margin from two put options) On 16 May 2015 McDonald’s (MCD)

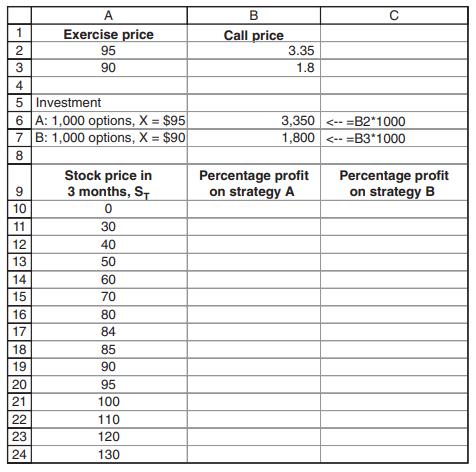

stock is trading at $98 per share. The price of a put option on MCD expiring 18 September 2015 is $1.80 for options with X = $90 and $3.35 for options with X = $95.

a. You think that shares of MCD will fall in price in the immediate future, and you want to speculate on the stock. Compare (graphically) the following two alternatives: purchasing 1,000 MCD options with an exercise price of $90 versus purchasing 1,000 MCD put options with a strike of $95.

b. Compare the two strategies. Which is preferable?

Use the following template:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi

Question Posted: