(Regression, Sharpe, Jensens alpha, Treynor) Consider the following data: a. Compute the excess returns for the S&P...

Question:

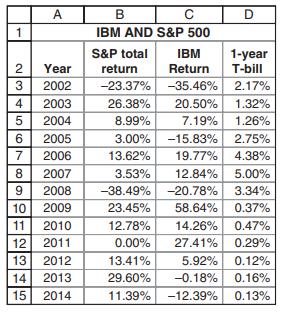

(Regression, Sharpe, Jensen’s alpha, Treynor) Consider the following data:

a. Compute the excess returns for the S&P 500 and for IBM.

b. Show by graph the excess return of IBM against those of the S&P 500.

Use Excel to compute the regression line and the R2

.

c. Does IBM have excess performance over the S&P 500?

d. Is IBM an aggressive or a defensive stock?

e. Calculate the Sharpe ratio, Jensen’s alpha, and Treynor ratio for IBM.

Step by Step Answer:

Related Book For

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi

Question Posted: