(Sharpe ratio) Genjamin Braham and Barren Wuffett had the following statistics for the last 5 years: Genjamin...

Question:

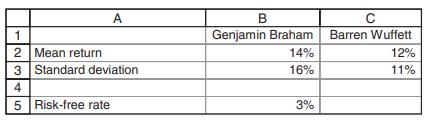

(Sharpe ratio) Genjamin Braham and Barren Wuffett had the following statistics for the last 5 years:

Genjamin Braham argues that since his mean return is higher than Barren Wuffett’s mean return, he is a better fund manager. However, Barren Wuffett argues that his risk is lower and should be taken into consideration.

a. Use the Sharpe ratio to determine which fund manager is better.

b. Assume that you would like to invest in a portfolio with standard deviation of 16% (the same risk as Genjamin Braham’s). Show how to construct this portfolio using the risk-free asset and Barren Wuffett’s fund, and calculate the average return of this portfolio.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi

Question Posted: