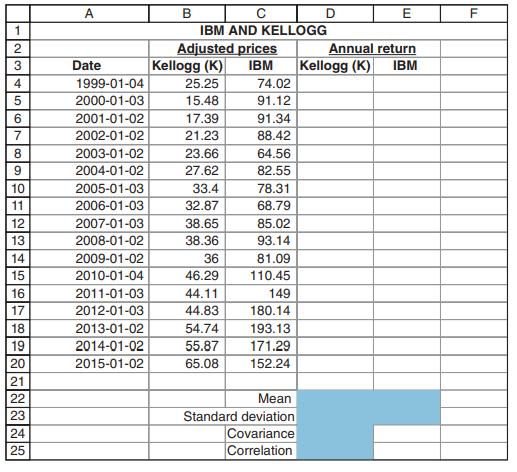

(Statistics and diversification of two stocks) Below please find the adjusted prices of Kellogg (K) and IBM:...

Question:

(Statistics and diversification of two stocks) Below please find the adjusted prices of Kellogg (K) and IBM:

a. Compute the annual return of each stock.

b. Compute the covariance and correlation coefficient between the returns of Kellogg and IBM.

c. Are there any advantages to diversifying between IBM and Kellogg?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi

Question Posted: