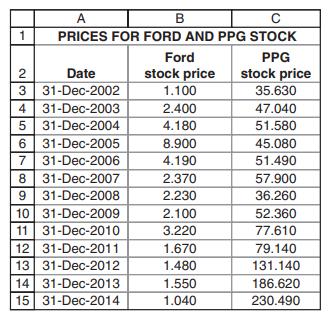

(Statistics for stocks and portfolio) The table below presents the year-end prices for the shares of Ford...

Question:

(Statistics for stocks and portfolio) The table below presents the year-end prices for the shares of Ford and PPG from 2002 to 2014:

a. Calculate the following statistics for these two shares: average return, variance of returns, standard deviation of returns, covariance of returns, and correlation coefficient.

b. If you invested in a portfolio composed of 50% Ford and 50% PPG, what would be the expected portfolio return and standard deviation?

c. Comment on the following statement: “Ford has lower returns and higher standard deviation of returns than PPG. Therefore, any rational investor would invest in PPG only and would leave Ford out of her portfolio.”

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi

Question Posted: