A business has an accounting year ending on 31 December. At 31 December 2007 the records contained

Question:

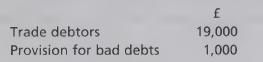

A business has an accounting year ending on 31 December. At 31 December 2007 the records contained the following accounts:

The trade debtors at 31 December 2008 were £18,900. The business decided at the end of the year to write off balances of £300 as bad debts. The trade debtors figure includes amounts of £250 owed by business C, £150 owed by business M, and £200 owed by business A, all of which are regarded as doubtful debts.

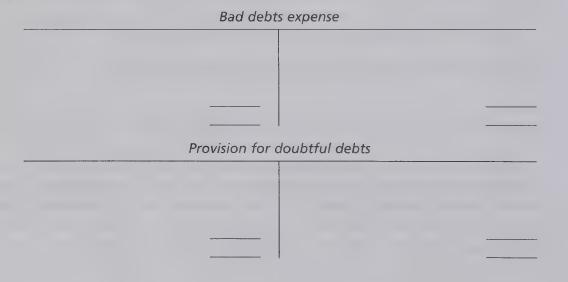

Required What is going to be the provision for doubtful debts as at 31 December 2008, given a general provision of 5 percent of trade debtors was applied? Show the T-accounts entries in respect of the above and the relevant profit and loss account and balance sheet extracts. Use the blank T-accounts provided below.

Step by Step Answer:

Financial Accounting A Practical Introduction

ISBN: 9780273714293

1st Edition

Authors: Ilias Basioudis