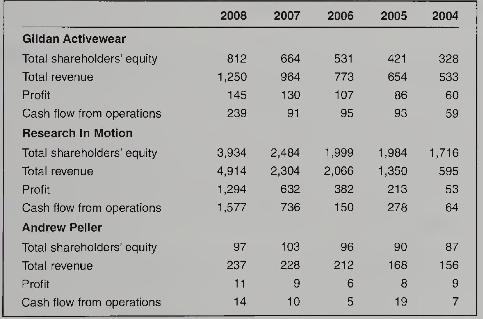

A summary of selected historical results is presented below for three Canadian companies: Gildan Activewear, Research In

Question:

A summary of selected historical results is presented below for three Canadian companies: Gildan Activewear, Research In Motion, and Andrew Peller. Each of these companies has grown in size over time by acquiring assets and investing in other companies. (Amounts are in millions of dollars.)

Required:

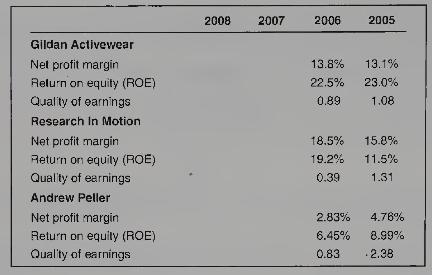

1. Compute the net profit margin and the return on equity ratios for each company for each of the Gildan Activewear Research In Motion Andrew Peller excel years 2007 and 2008 by using the table on the following page.

2. Based on the computed ratios, rank these companies from most successful to least successful in generating profit for shareholders.

3. Assume that you are interested in investing in one of these three companies, which company would you choose? Write a brief report to justify your choice.

4. Analysts examine both the profit and the cash flow from operating activities in evaluating a company. One measure that relates these two numbers is the quality of earnings ratio, which equals cash flow from operations divided by profit. The higher the ratio, the higher the quality of earnings. Compute this ratio for 2007 and 2008, and rank the three companies from highest to lowest based on the quality of their earnings.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby