ACCOUNTING ALTERNATIVES AND FINANCIAL ANALYSIS. Shady Deal Automobile Sales Company has asked your bank for a $100,000

Question:

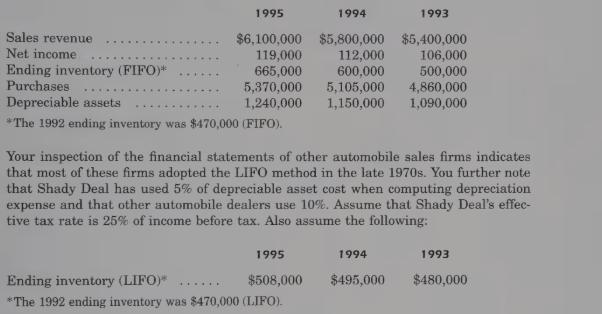

ACCOUNTING ALTERNATIVES AND FINANCIAL ANALYSIS. Shady Deal Automobile Sales Company has asked your bank for a $100,000 loan to expand its sales facility. Shady Deal provides you with the following data:

REQUIRED:

1. Compute cost of goods sold for 1995, 1994, and 1993, using both the FIFO and the LIFO methods.

2. Compute depreciation expense for Shady Deal for 1995, 1994, and 1993, using both 5% and 10% of the cost of depreciable assets. .

3. Recompute Shady Deal’s net income for 1995, 1994, and 1993, using LIFO and 10%

depreciation. (Don’t forget the tax impact of the increases in cost of goods sold and depreciation expense.)

4. Does Shady Deal appear to have materially changed its financial statements by the selection of FIFO (rather than LIFO) and 5% (rather than 10%) depreciation?

Step by Step Answer: