ACCOUNTING FOR LONG-TERM INVESTMENTS IN COMMON STOCK. On January 1, 19x6, Stern Corporation purchased 100 shares of

Question:

ACCOUNTING FOR LONG-TERM INVESTMENTS IN COMMON STOCK. On January 1, 19x6, Stern Corporation purchased 100 shares of common stock issued by Milstein, Inc. (representing 12% of the total shares outstanding) for $6,000 cash and 500 shares of Heifetz, Inc. (representing 25% of the total shares outstanding) for

/ $20,000 cash. Assume that the acquisition cost of each investment equals the book value of the related stockholders’ equity on the records of the investee. During 19x6 Milstein declared and paid cash dividends to Stern of $500, and Heifetz declared and paid cash dividends to Stern of $1,700. Milstein reported 19x6 net income of $12,000, and Heifetz reported 19x6 net income of $15,000. On December 31, 19x6, the market value of the 100 shares of Milstein was $6,450, and the market value of the 500 shares of Heifetz was $19,720.

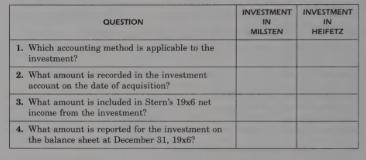

REQUIRED:

On your own paper, list the answers to complete the following table, which raises questions about the investor’s accounting for the two investments:

Step by Step Answer: