ACCRUED LIABILITY CHANGES AND THE STATEMENT OF CASH FLOWS. Rod Bucher, the accountant for Greens Appliance Stores,

Question:

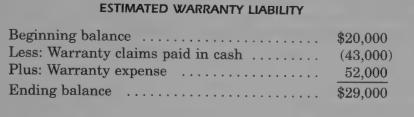

ACCRUED LIABILITY CHANGES AND THE STATEMENT OF CASH FLOWS. Rod Bucher, the accountant for Green’s Appliance Stores, has asked you how to account for warranty expense and the change in the estimated warranty liability (a current liability) in the statement of cash flows. Rod provides you with the following data:

REQUIRED:

1. Should the amount of warranty expense be a positive adjustment to net income in the indirect method of determining cash flows from operations (as are depreciation, depletion, land amortization)? ;

2. How would you account for $52,000 of warranty expense and the $9,000 increase in the estimated warranty liability?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: