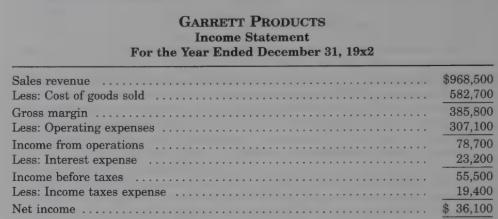

ADJUSTMENTS AND THE INCOME STATEMENT. Garrett Products accountant prepared the following income statement for 19x2: After reviewing

Question:

ADJUSTMENTS AND THE INCOME STATEMENT. Garrett Products’ accountant prepared the following income statement for 19x2:

After reviewing the accounting records, the accountant noticed that the following four items had been accounted for incorrectly when the 19x2 income statement was prepared:

a) 19x2 depreciation expense in the amount of $3,150 on a delivery truck was unrecorded.

b) Supplies inventory costing $2,470 was overlooked when the physical inventory was taken at December 31, 19x2.

c) An insurance policy that was purchased in 19x2 provided insurance coverage for 19x3 in the amount of $940. The full cost of the policy was recorded as an expense in 19x2.

d) Wages in the amount of $380 that were paid early in 19x2 and recorded as a 19x2 expense had actually been earned in 19x1.

REQUIRED:

Correct the affected income statement amounts and then revise the 19x2 income statement. (Assume that no tax effect results from these changes.)

Step by Step Answer: