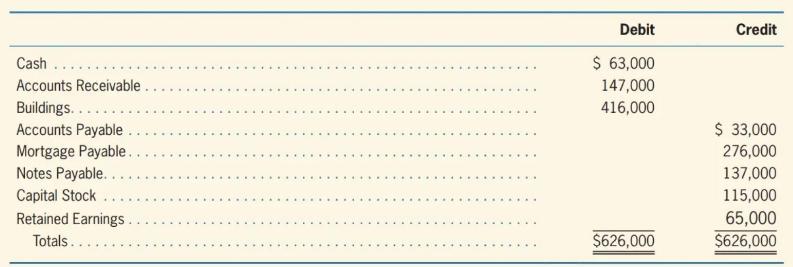

As of January 1, 2022, Gammon Corporation had the following balances in its general ledger: Gammon had

Question:

As of January 1, 2022, Gammon Corporation had the following balances in its general ledger:

Gammon had the following transactions during 2022. All expenses were paid in cash, unless otherwise stated.

a. Collected \(\$ 42,000\) of receivables.

b. Accounts Payable as of January 1, 2022, were paid off.

c. Paid utilities of \(\$ 12,600\).

d. Provided services for \(\$ 370,000,90 \%\) for cash and \(10 \%\) for credit.

e. Paid \(\$ 50,000\) mortgage payment, of which \(\$ 30,000\) represents interest expense.

f. Paid salaries expense of \(\$ 120,000\).

g. Paid installment of \(\$ 10,000\) on note.

Required:

1. Prepare journal entries to record each listed transaction. (Omit explanations.)

2. Set up T-accounts with the proper account balances at January 1, 2022, post the journal entries to the T-accounts, and prepare a trial balance for Gammon Corporation at December 31, 2022.

3. Interpretive Question: If the debit and credit columns of the trial balance are in balance, does this mean that no errors have been made in journalizing the transactions? Explain.

Step by Step Answer:

Principles Of Financial Accounting IFRS Edition

ISBN: 9789814962605

3rd Edition

Authors: Earl K Stice, James D Stice, W Steve Albrecht, Monte R Swain, Rong-Ruey Duh, Audrey Wenhsin Hsu