Babycare accounting year ends each 31 January. Assume you are dealing with a single Babycare store in

Question:

Babycare accounting year ends each 31 January. Assume you are dealing with a single Babycare store in Leamington Spa, Warwickshire and that the following transactions need to be recorded: opening stock in 20x5 of 20,000 units that cost a total of £1,200,000.

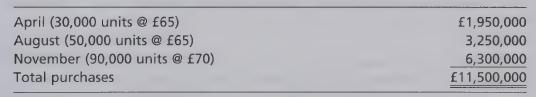

During the year the store purchased goods on credit as follows:

Cash payments to suppliers during the year totalled £11,190,000.

During fiscal year 20x5, the store sold 180,000 units of goods for £16,400,000, of which £5,300,000 was for cash and the remaining was on credit. Babycare uses the LIFO stock valuation method.

Operating expenses for the year were £3,500,000, and the store paid 75 percent in cash and accrued the rest. Also, the store accrued income tax at the rate of 30 percent.

Required

1 Make summary journal entries to record the store’s transactions for the year ended 31 January 20x5. Babycare uses the perpetual inventory method to record stocks.

2 Determine the closing stock based on LIFO stock valuation method using a T-account.

3 Prepare the store’s income statement for the year ended 31 January 20x5.

Step by Step Answer:

Financial Accounting A Practical Introduction

ISBN: 9780273714293

1st Edition

Authors: Ilias Basioudis