Berj Corporation issued bonds and received cash in full for the issue price. The bonds were dated

Question:

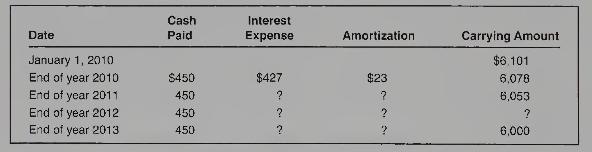

Berj Corporation issued bonds and received cash in full for the issue price. The bonds were dated and issued on January 1, 2010. The coupon rate was payable at the end of each year. The bonds mature at the end of four years. The following schedule has been partially completed (amounts in thousands):

\section*{Required:}

1. Complete the amortization schedule.

2. What was the maturity amount of the bonds?

3. How much cash was received at the date of issuance (sale) of the bonds?

4. What was the amount of discount or premium on the bond?

5. How much cash will be disbursed for interest each period and in total for the full life of the bond issue?

6. What method of amortization is being used? Explain.

7. What is the coupon rate of interest?

8. What is the effective rate of interest?

9. What amount of interest expense should be reported on the income statement each year?

10. Show how the bonds should be reported on the statement of financial position at the end of each year (show the last year immediately before repayment of the bonds).

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby