Bonnie and Clyde have been in partnership for several years sharing profits equally. The partnership accounting year-end

Question:

Bonnie and Clyde have been in partnership for several years sharing profits equally.

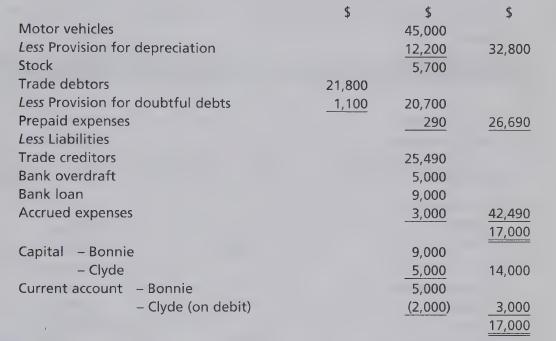

The partnership accounting year-end is 31 December. On 20 February 2009, they have decided to dissolve the partnership. After preparing the profit and loss account for the period 1 January 2009 to 20 February 2009, the balance sheet as at the latter date is as follows:

One of the motor vehicles was taken over by Clyde at an agreed valuation of $10,000.

The remainder of the vehicles were sold for $15,500. The stock realised $6,500 and $17,800 was received from trade debtors. A refund of the full amount of prepaid expenses was also received. Trade creditors were paid $20,900 in full settlement. The bank loan was fully repaid, including an interest penalty for early settlement of $250.

Accrued expenses were also fully paid off. Expenses for dissolving the partnership amounted to $1,500. The partnership also sold its business name and a list of its customers to a competitor for $3,000.

Required 1 Prepare the partnership's realisation account.

2 Prepare the partnership’s bank account.

3 Prepare the partners’ capital accounts.

Step by Step Answer:

Financial Accounting A Practical Introduction

ISBN: 9780273714293

1st Edition

Authors: Ilias Basioudis