Briggs & Stratton Engines Inc. uses the aging approach to estimate bad debt expense at the end

Question:

Briggs \& Stratton Engines Inc. uses the aging approach to estimate bad debt expense at the end of each fiscal year. Credit sales occur frequently on terms \(n / 45\). The balance of each trade receivable is aged on the basis of four time. periods as follows: (1) not yet due, (2) up to 6 months past due, (3) 6 to 12 months past due, and (4) more than one year past due. Experience has shown that for each age group, the average bad debt rate on the amounts receivable at year-end due to uncollectibility is (1) 1 percent, (2) 5 percent, (3) 20 percent, and (4) 50 percent, respectively.

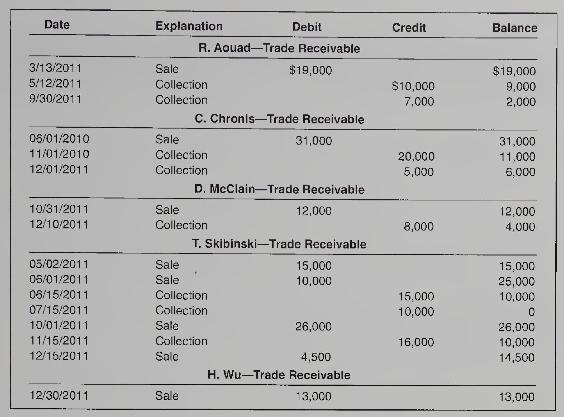

At December 31, 2011 (end of the current fiscal year), the trade receivables balance was \(\$ 39,500\), and the allowance for doubtful accounts balance was \(\$ 1,550\) (debit). To simplify, the accounts of only five customers are used; the details of each follow:

Required:

1. Set up an aging analysis schedule and complete it.

2. Compute the estimated uncollectible amount for each age category and in total.

3. Prepare the adjusting entry for bad debt expense at December 31, 2011.

4. Show how the amounts related to trade receivables should be presented on the income statement for 2011 and the statement of financial position at December 31, 2011.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby