Cayuga Ltd. prepared the following trial balance at the end of its first year of operations ending

Question:

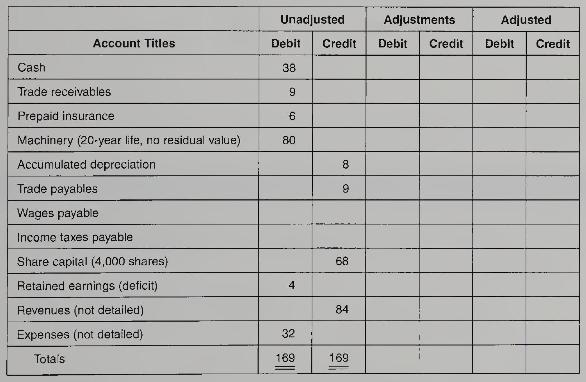

Cayuga Ltd. prepared the following trial balance at the end of its first year of operations ending December 31, 2012. To simplify the case, the amounts given are in thousands of dollars. Other data not yet recorded at December 31, 2012:

a. Insurance expired during \(2012, \$ 4\).

b. Depreciation expense for \(2012, \$ 4\).

c. Wages payable, \(\$ 8\).

d. Income tax expense, \(\$ 9\).

Required:

1. Prepare the adjusting entries for 2012.

2. Show the effects (direction and amount) of the adjusting entries on profit and cash.

3. Complete the trial balance Adjustments and Adjusted columns.

4. Using the adjusted balances, prepare an income statement, a statement of changes in equity, and a statement of financial position.

5. What is the purpose of "closing the books" at the end of the accounting period?

6. Using the adjusted balances, prepare the closing entries for 2012.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby