COMPARING FINANCIAL RATIOS. Presented below are selected ratios for four firms: Caterpillar (a heavy-equipment manufacturer), Gannett (a

Question:

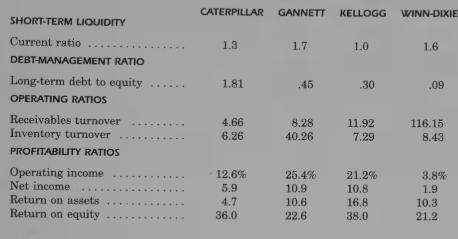

COMPARING FINANCIAL RATIOS. Presented below are selected ratios for four firms: Caterpillar (a heavy-equipment manufacturer), Gannett (a newspaper pub- lisher), Kellogg (a food manufacturer), and Winn-Dixie (a grocery chain).

REQUIRED:

1. Why is there little difference among the four firms in the current ratio?

2. Why would the turnover ratios vary so much among the four firms?

3. Why is the return on equity ratio larger than the return on asset ratio for all four firms?

4. Can the large differences in the return on equity ratios exist over long periods of time?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: