Consider the following transactions for Liner Company: a. Collected ($ 1,500) rent for the period December 1,

Question:

Consider the following transactions for Liner Company:

a. Collected \(\$ 1,500\) rent for the period December 1, 2011, to March 1, 2012, which was credited to deferred rent revenue on December \(1,2011\).

b. Paid \(\$ 1,800\) for a one-year insurance premium on July 1, 2011; debited prepaid insurance for that amount.

c. Purchased a machine for \(\$ 10,000\) cash on January 1,2010 ; estimated a useful life of five years with a residual value of \(\$ 2,000\).

Required:

1. Prepare the adjusting entries required for the year ended December 31, 2011, using the process illustrated in the chapter.

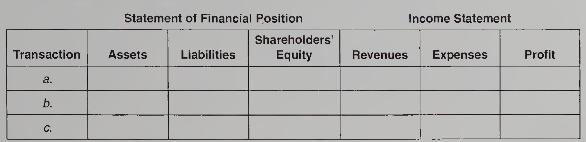

2. For each of the transactions above, indicate the amounts and direction of effects of the adjusting entry on the elements of the statement of financial position and income statement. Use the following format: + for increase, - for decrease, and NE for no effect.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby