CONSOLIDATED INCOME STATEMENT. Johnson, Inc., is the wholly owned subsidiary of Stuart Corporation. The 19x1 income statements

Question:

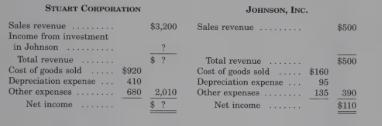

CONSOLIDATED INCOME STATEMENT. Johnson, Inc., is the wholly owned subsidiary of Stuart Corporation. The 19x1 income statements for the two corporations are as follows:

The acquisition cost of Stuart’s 100% ownership interest in Johnson equaled its book value on Johnson’s records. During 19x1 Johnson pays a cash dividend of $25 to Stuart.

REQUIRED:

1. Calculate the income from investment in Johnson as reported on Stuart’s income statement.

2. Calculate the 19x1 net income reported by Stuart on its parent company income statement.

3. Prepare the 19x1 consolidated income statement for Stuart and Johnson.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: