Dixon, Cowell and Cooper are in partnership sharing profits and losses in the ratio 2:2:1 respectively. During

Question:

Dixon, Cowell and Cooper are in partnership sharing profits and losses in the ratio 2:2:1 respectively.

During the year ended 31 December 2007 the net profit of the firm was €30,538.

You are also given the following information:

Interest is allowed on partners’ capitals at the rate of 6 percent per annum. Cowell is entitled to a salary of €9,000 per annum. The partners agreed that Dixon should withdraw €10,000 from her capital at 1 July 2007 and that Cooper should contribute a similar amount as at that date.

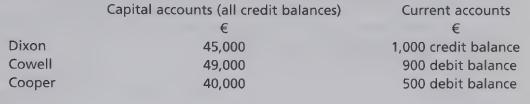

The balances on the partners’ accounts at 1 January 2007 were:

Required 1 Prepare the partnership profit and loss appropriation account.

2 Show the partners’ capital for the year ended 31 December 2007.

3 Prepare the partners’ current accounts for the year ended 31 December 2007.

Step by Step Answer:

Financial Accounting A Practical Introduction

ISBN: 9780273714293

1st Edition

Authors: Ilias Basioudis