During 20x7, Dasbol Corporation engaged in two complex transactions to improve the businessselling off a division and

Question:

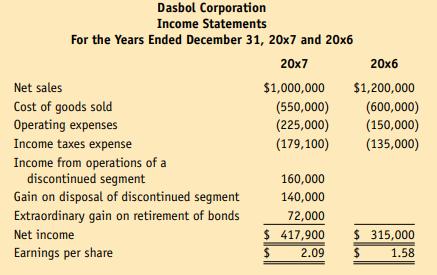

During 20x7, Dasbol Corporation engaged in two complex transactions to improve the business—selling off a division and retiring bonds. The company has always issued a simple single-step income statement, and the accountant has accordingly prepared the December 31 year-end income statements for 20x6 and 20x7, as shown below.

Joseph Dasbol, the president of Dasbol Corporation, is pleased to see that both net income and earnings per share increased by almost 33 percent from 20x6 to 20x7 and intends to announce to the company’s stockholders that the plan to improve the business has been successful.

Required 1. Recast the 20x7 and 20x6 income statements in proper multistep form, including allocating income taxes to appropriate items (assume a 30 percent income tax rate) and showing earnings per share figures (200,000 shares outstanding).

2. User Insight: What is your assessment of Dasbol Corporation’s plan and business operations in 20x7?

Dividends, Stock Splits, and Stockholders’ Equity

Step by Step Answer: