EFFECTS OF INVENTORY COSTING METHODS ON INCOME TAX PAYMENTS. Jefferson Enterprises has the following income statement data

Question:

EFFECTS OF INVENTORY COSTING METHODS ON INCOME TAX PAYMENTS.

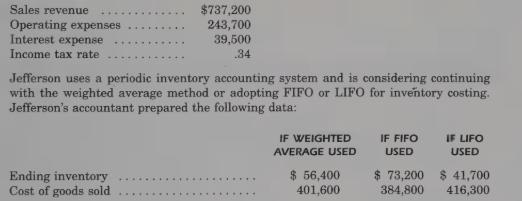

Jefferson Enterprises has the following income statement data available for 19x9:

REQUIRED:

1. Compute income before taxes, income taxes expense, and net income for each of the three inventory costing methods.

2. Why are the cost of goods sold and ending inventory amounts different for each of the three methods?

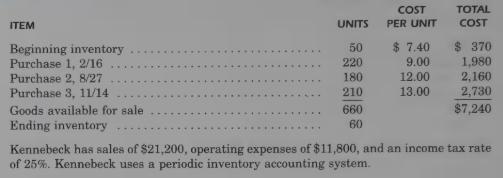

E7-44, EFFECTS OF INVENTORY COSTING METHODS ON CASH OUTFLOWS FOR INCOME TAXES. Kennebeck Stores has the following inventory data:

REQUIRED:

1. Compute ending inventory and cost of goods sold using the FIFO, LIFO, and weighted average methods of inventory accounting.

2. By how much will cash outflows for income taxes differ among the three inventory methods?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: