FINANCIAL STATEMENT ANALYSIS. Dayton Hudson Corporation is a large retailer operating Target, Mervyns, Daytons, Hudsons, and Marshall

Question:

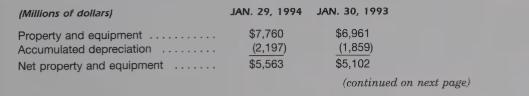

FINANCIAL STATEMENT ANALYSIS. Dayton Hudson Corporation is a large retailer operating Target, Mervyns, Daytons, Hudsons, and Marshall Fields stores. The balance sheets in-its 1993 annual report show the following information for property and equipment:

REQUIRED:

1. Based on the information in just the balance sheets, what did Dayton Hudson spend for additions to property and equipment and what was depreciation expense?

2. In its “Consolidated Results of Operations” statement (income statement), Dayton Hudson reported depreciation expense to be $498 million for the year ended January 29, 1994. How does this amount compare with the amount you calculated in requirement 1? What could explain the difference?

3. In its “Consolidated Statement of Cash Flows,” Dayton Hudson reported that expenditures for property and equipment totaled $969 million. How does this amount compare with the amount you calculated in requirement 1? What could explain the difference?

4. If Dayton Hudson received $22 million for property and equipment sold during the year, what was the gain or loss on the sale?

Step by Step Answer: