Geox S.p.A. is an Italy-based company active in the footwear and apparel manufacturing industry, which includes classic,

Question:

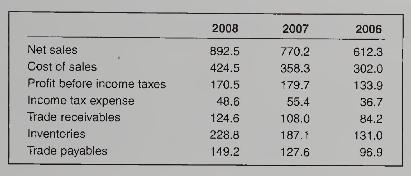

Geox S.p.A. is an Italy-based company active in the footwear and apparel manufacturing industry, which includes classic, casual, and sports footwear, as well as apparel for men, women, and children. The company's products are sold in more than 70 countries worldwide through a widespread distribution network. Geox prepares its financial statements in accordance with the International Financial Reporting Standards. The following table includes selected information from its financial statements (amounts in millions of euro).

Required:

1. Compute the following amounts for each of the fiscal years 2007 and 2008:

a. Collections from customers.

b. Purchases of merchandise from suppliers. Assume for simplicity that the company buys its products from other manufacturers.

c. Payments to suppliers.

d. Trade receivables turnover ratio and the average collection period.

e. Inventory turnover ratio and the average period to sell inventory.

f. Average period for conversion of inventories into cash.

2. The company uses the indirect method to report its cash flows from operations. How would the changes in trade receivables, inventory, and trade payables be reported in the operating activities section of its statement of cash flows for \(2008 ?\)

3. In the notes to its financial statements, the company states that the cost of merchandise is determined by using the weighted-average costing method. Would you expect the company's profit to increase or decrease if it used FIFO instead of weighted-average cost? Explain.

4. Assume that the company purchased goods from a supplier in the Far East with terms F.O.B. destination. These goods, which cost \(€ 1.2\) million, were shipped on December 24, 2008, but had not arrived by December 31. The company's accountant included the cost of these goods in inventory at year-end. Is that an error? If so, what effect would this error have on the company's profit for 2008 ? Show calculations.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby