In its 2004 annual report, Nike, Inc., the athletic sportswear company, provided the following data about its

Question:

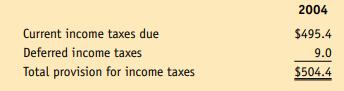

In its 2004 annual report, Nike, Inc., the athletic sportswear company, provided the following data about its current and deferred income tax provisions

(in millions):

1. What were the 2004 income taxes on the income statement? Record in journal form the overall income tax liability for 2004, using income tax allocation procedures.

2. Nike’s balance sheet contains both deferred income tax assets and deferred tax liabilities. How do such deferred income tax assets arise?

How do such deferred income tax liabilities arise? Given the definition of assets and liabilities, do you see a potential problem with the company’s classifying deferred income taxes as a liability? Why or why not?

Decision Analysis Using Excel Analyzing Effects of Stockholders’ Equity Transactions

Step by Step Answer: