INTERPRETING THE EQUITY SECTION. The following information is taken from financial statements and notes included in the

Question:

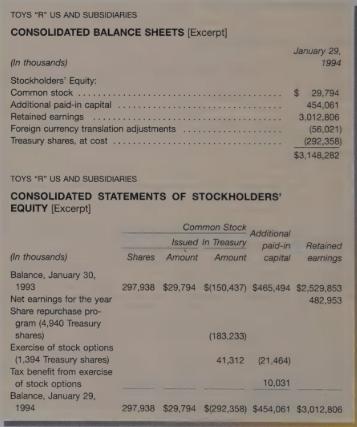

INTERPRETING THE EQUITY SECTION. The following information is taken from financial statements and notes included in the annual report of Toys “R” Us:

REQUIRED:

1.

Approximately 2.8% of shares issued are held as treasury shares (.028 = 8,416 +

297,938). Yet the treasury shares account balance is 60.4% of the total contributed capital for all common stock [.604 = $292,358 + ($29,794 + $454,061)]. How can this be?

Why does Toy “R” Us purchase treasury shares?

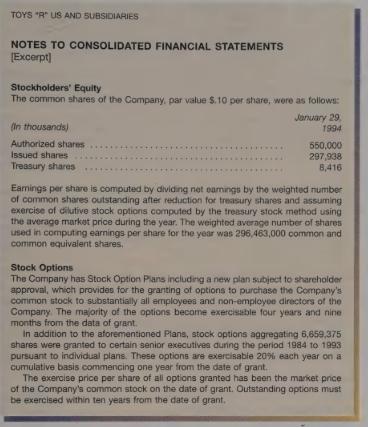

Why must earnings per share be adjusted for the future exercise of stock options?

. What is the general purpose of the company’s stock option plans?

. The note on stock options states that shareholders must approve the new stock option plan, as required by law in most states. Why does such a requirement exist?

If you were a shareholder, what considerations would influence your decision to vote for or against the new stock option plan?

. Suppose that you are a senior executive at Toys “R” Us and receive the option to buy 5,000 shares. How will you decide when to exercise this option?

Step by Step Answer: