Legrand Company has outstanding 45;000 common shares and 25,000, $4, preferred shares. On December 1, 2011, the

Question:

Legrand Company has outstanding 45;000 common shares and 25,000, \$4, preferred shares. On December 1, 2011, the board of directors voted to distribute a \(\$ 4\) cash dividend per preferred share and a 5 percent common stock dividend on the common shares. At the date of declaration, the common share was selling at \(\$ 40\) and the preferred share at \(\$ 50\). The dividends are to be paid, or issued, on February 15, 2012. The company's fiscal year ends on December 31.

\section*{Required:}

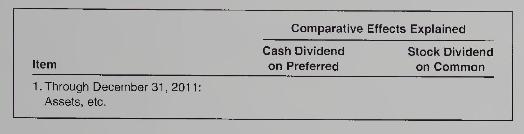

Explain the comparative effects of the two dividends on the assets, liabilities, and shareholders' equity

(a) through December 31, 2011,

(b) on February 15, 2012, and

(c) the overall effects from December 1, 2011, through February 15, 2012. A schedule similar to the following might be helpful:

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby