Mawani Company sells a wide range of goods through two retail stores operating in adjoining cities. Most

Question:

Mawani Company sells a wide range of goods through two retail stores operating in adjoining cities. Most purchases of goods for resale are on account. Occasionally, a short-term note payable is used to obtain cash for current use. The following transactions were selected from those occurring during 2012:

a. On January 10, 2012, purchased merchandise on credit, $36,000; the company uses a perpetual inventory system.

b. On March 1, 2012, borrowed $200,000 cash from Local Bank and signed an interest-bearing note payable at the end of one year, with an annual interest rate of 6 percent payable at maturity.

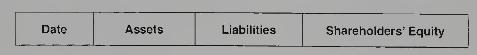

c. On April 5, 2012, sold merchandise on credit, $67,800; this amount included GST of $3,000 and PST of $4,800. The cost of sales represents 70 percent of the sales invoice. Required: 1. Describe the financial statement effects of these transactions. Indicate the accounts affected, amounts, and direction of the effects (+ for increases and for decreases) on the accounting equation. Use the following headings:

2. What amount of cash is paid on the maturity date of the note?

3. Discuss the impact of each transaction on Mawani's cash flows.

4. Discuss the impact of each transaction on the current ratio. Assume that the current ratio is greater than 1.0 before considering each transaction.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby