MINIMIZING TAXES. Heindenreich and Company has asked you for advice regarding the sale of some of its

Question:

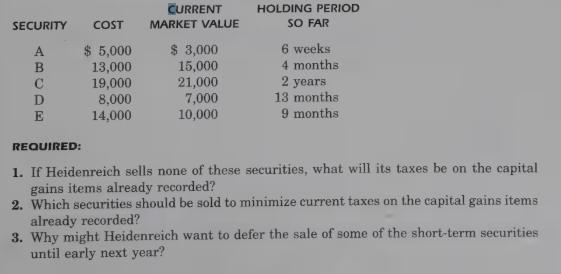

MINIMIZING TAXES. Heindenreich and Company has asked you for advice regarding the sale of some of its capital assets to minimize current taxes. Assume that Heidenreich’s income before any additional sales of capital assets is $100,000. Heidenreich has already recorded long-term capital gains of $30,000 and short-term capital gains of $4,000 for 19x3.

C

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: