Mr Xo owns a retail shop. You prepare annually the profit and loss account and balance sheet

Question:

Mr Xo owns a retail shop. You prepare annually the profit and loss account and balance sheet from records consisting of a bank statement and a file of unpaid suppliers and outstanding debtors.

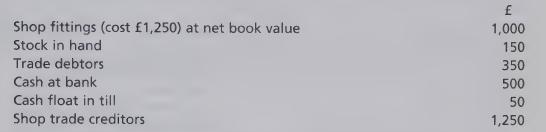

The following balances were shown on his balance sheet at 1 August 2008:

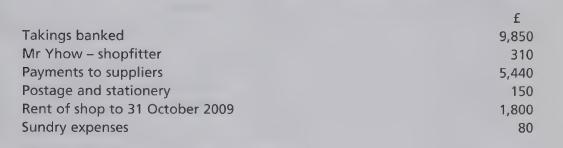

The following is a summary of his bank statement for the year ended 31 July 2009:

You obtain the following additional information:

a Takings are banked daily and all suppliers are paid by cheque, but Mr Xo keeps £200 per week for himself, and pays his assistant £250 per week out of the cash takings.

b The work done by Mr Yhow was for new shelving and repairs to existing fittings in the shop. The cost of the new shelves was £250.

c The cash float in the till was considered insufficient and raised to £75.

d Mr Xo took goods for his own use without payment. The selling price of those goods are £255.

e Your charges as the shop’s accountant will be £100 for preparing the accounts.

f The outstanding accounts file shows £1,300 due to suppliers, £20 due in respect of sundry expenses, and £120 outstanding debtors.

g Depreciation on shop fittings is provided at 10 percent on cost, a full year’s charge being made in year of purchase.

h Stock in hand at 31 July 2009 was £550.

Required 1 Prepare Mr Xo’s profit and loss account for the year ended 31 July 2009.

2 Prepare Mr Xo’s balance sheet as at 31 July 2009.

Step by Step Answer:

Financial Accounting A Practical Introduction

ISBN: 9780273714293

1st Edition

Authors: Ilias Basioudis